Income Tax Return (ITR) Filing Services in Delhi NCR

Contact us for ITR Filing Service you can trust.

Call Anytime

+918130622684

Simplify Your Tax Filing with KNV Tax Consultancy

Understanding and managing your income tax responsibilities can feel overwhelming without the right support. At KNV Tax Consultancy, we specialize in providing comprehensive and hassle-free ITR filing services in Delhi. With over 7 years of experience, our dedicated team ensures accurate and timely filing, tailored to your specific financial needs.

Understanding Different ITR Forms

Choosing the appropriate ITR form ensures your income is reported correctly and helps avoid filing errors. Here’s a brief overview:

ITR 1 (Sahaj)

This form is ideal for salaried individuals who earn from one residential property and have additional income such as interest, as long as their total income remains under fifty lakh rupees.

ITR 2

This form is suitable for individuals and Hindu Undivided Families who are not involved in any business or professional activity but may earn through capital gains multiple house properties or foreign assets and income.

ITR 3

This return is designed for individuals or Hindu Undivided Families earning from business operations or professional work, including those associated as partners in a firm without owning the business individually. However, it is not meant for those managing a proprietorship under their own name.

ITR 4 (Sugam)

This form caters to individuals, Hindu Undivided Families, or partnership firms other than LLPs who opt for the presumptive taxation scheme, making it easier for small businesses and professionals to file their returns.

ITR 5

This is used by partnership firms, LLPs, Associations of Persons (AOPs), and Bodies of Individuals (BOIs) who are not covered under ITR-7.

ITR 6

Applicable to all companies, except those claiming exemption under Section 11 (primarily for charitable or religious organizations).

ITR 7

This form is required for organizations such as trusts, political parties, research institutions, and similar entities that need to file income tax returns under specific clauses like 139(4A) to 139(4D), especially where income is exempt but filing is mandatory.

Essential Documents for GST Return Filing

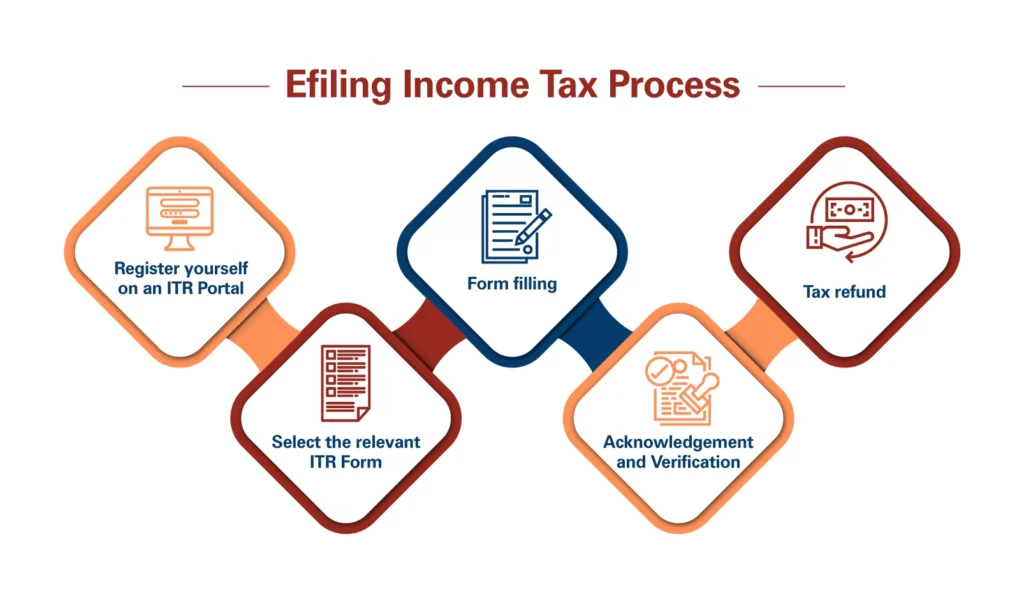

Initial Consultation: Understanding your financial profile and requirements.

Document Collection: Your financial information is treated with complete privacy and safeguarded using robust data protection measures at every step.

Data Verification and Computation: Accurate calculation of income, deductions, and tax liabilities.

Review and Approval: Sharing the computed details for your review and approval.

Once your return is submitted, we share the official acknowledgment with you as proof of successful filing.

Benefits of Timely ITR Filing

Engaging with a professional income tax consultancy like KNV Tax Consultancy offers numerous advantages:

Loan and Visa Applications: Filed ITRs serve as proof of income, facilitating smoother loan and visa processes.

Claiming Refunds: Ensure you receive any due refunds by filing accurately and on time.

Avoiding Penalties: Timely filing helps in avoiding late fees and penalties imposed by the tax authorities.

Financial Record Maintenance: Regular filing maintains a clear financial record, beneficial for future financial planning.