TDS Return Filing in Delhi (Dwarka, West & South)

Contact us for TDS Return Filing Service you can trust.

Call Anytime

+918130622684

Demystifying TDS Return Filing

Think of Tax Deducted at Source (TDS) as a system where a portion of specific payments is set aside for taxes right when the payment is made. Filing TDS returns is the crucial step that formally reports these deductions, ensuring the government accurately credits the tax collected.

Who Bears the Responsibility of TDS Filing?

If your role involves making certain payments – whether you’re an employer issuing salaries, a business engaging contractors, or any entity disbursing specific incomes – you’re likely obligated to deduct TDS and file quarterly returns. KNV Tax Consultancy provides comprehensive support for businesses and individuals of all sizes across Dwarka, West Delhi, and South Delhi in meeting these responsibilities.

Understanding Your TDS Certificate

As official proof of tax deduction and government remittance, the entity or person withholding TDS provides a formal TDS Certificate. For income earned as salary, this is documented in Form 16, whereas Form 16A serves as the equivalent for other income categories. These certificates are essential for claiming tax credits during the filing of your income tax return.

Our Tailored TDS Return Filing Services

As official proof of tax deduction and government remittance, the entity or person withholding TDS provides a formal TDS Certificate. For income earned as salary, this is documented in Form 16, whereas Form 16A serves as the equivalent for other income categories. These certificates are essential for claiming tax credits during the filing of your income tax return.

Our Tailored TDS Return Filing Services

Form 24Q (Salary TDS) – Expert Handling in Dwarka, West & South Delhi: We provide meticulous quarterly filing services for Form 24Q, ensuring complete accuracy for employers in Dwarka, West Delhi, and South Delhi.

Form 26Q (Non-Salary TDS) – Meticulous Attention to Detail: For reporting TDS on non-salary income (rent, professional fees, etc.), Form 26Q requires precision. Our team ensures timely and error-free submissions for all such transactions.

Navigating TDS for International Payments (Form 27Q): When your business engages with individuals or entities outside India, precise adherence to international tax laws via Form 27Q is non-negotiable. Our expertise ensures these filings are managed flawlessly, guaranteeing your complete compliance and freeing you from potential complexities.

Streamlining Your TCS Return Filings (Form 27EQ): For businesses obligated to collect tax at the source, the quarterly filing of Form 27EQ is a critical responsibility. KNV Tax Consultancy offers a streamlined and fully compliant process, simplifying this essential task for you.

Stay Ahead of Deadlines: Timely TDS Return Filing is Key

Eliminate the worry of TDS return deadlines. Overlooking these quarterly filings can lead to unwelcome penalties and potential legal entanglements. Our proactive approach ensures these critical dates are handled with precision, giving you the assurance that your returns are filed punctually and without stress.

Navigating the Hurdles of TDS Filing

Common pitfalls like incorrect PAN details, mismatched payment records, or delayed remittances can trigger penalties and notices. Our meticulous approach ensures all data is thoroughly verified before submission, safeguarding you from these complications.

The Cost of Delay: Late Filing Penalties and Consequences

A delay in filing your TDS return attracts a late fee of ₹200 per day, which continues to accrue until the return is duly filed. Furthermore, you could face interest charges and legal notices. Trust our expertise to help you steer clear of these financial and legal repercussions.

Why Timely TDS Filing Matters

Timely submission of TDS returns goes beyond basic compliance—it reflects your dedication to regulatory integrity, helps steer clear of penalties, and builds confidence among employees and business partners. Crucially, it also enables those from whom tax was deducted to claim their rightful tax credits without any delays.

The Tangible Benefits of Timely TDS Payments

- Legal Compliance: Ensures you operate within the bounds of tax regulations.

- Enhanced Reputation: Builds credibility and trust with stakeholders.

- Reduced Tax Burden: Avoids unnecessary penalties and interest.

- Financial Transparency: Promotes clear and accountable financial practices.

Expert Support for TDS Return Corrections

Need to rectify a previously filed TDS return? Our experienced team offers prompt and accurate assistance in preparing and submitting TDS correction statements.

Understanding the Mechanics of TDS and Your Deduction Responsibilities

TDS is based on the principle of tax deduction at the point of payment, ensuring the government receives its due taxes promptly. If your payments exceed specific threshold limits, you are obligated to deduct TDS and subsequently file returns. We simplify this entire process for a smooth and understandable experience.

Our Streamlined TDS Filing Step by Step Process

Comprehensive Document Review and Verification: We meticulously examine all necessary documents to ensure accuracy.

Precise Preparation of TDS Challans and Data Entry: We handle the complexities of challan preparation and accurate data input.

Seamless Filing with the Income Tax Department: We ensure your returns are filed correctly and on time with the relevant authorities.

Prompt Sharing of Acknowledgment and Issuance of TDS Certificates: We provide you with the necessary documentation for your records and for distribution to deductees.

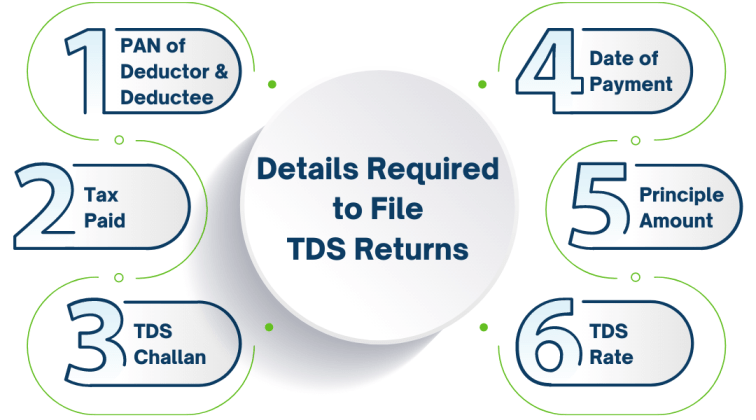

Key Documents Required for TDS Return Filing

- Tax Deduction and Collection Account Number (TAN) and Permanent Account Number (PAN) details

- Detailed records of payments made and taxes deducted

- Copies of TDS payment challans

- PAN details of the individuals or entities from whom tax was deducted (deductees)

- Relevant bank transaction statements

- Copies of previous TDS filings, if applicable

Why KNV Tax Consultancy is Your Ideal Partner

- Deep Expertise: Our professional team possesses in-depth knowledge of the intricacies of TDS rules and regulations.

- Consistent Accuracy and Timeliness: We guarantee error-free filing every quarter, ensuring you meet all deadlines.

- Personalized Support: We offer dedicated, one-on-one assistance tailored to the unique needs of our clients in Dwarka, West Delhi, and South Delhi.

- Affordable Solutions: Our service packages are competitively priced for individuals, businesses, and corporations.

- Comprehensive Assistance: We provide support for both initial filings and any necessary corrections or late filings.

Contact TDS Return Filing Experts

- End-to-end TDS return filing

- Support for salary & non-salary TDS (Form 24Q, 26Q)

- TCS return filing (Form 27EQ)

- Personalized assistance and prompt support

- Serving clients across Delhi NCR and beyond

Reach out to KNV Tax Consultancy today, where compliance meets excellence.